Hope you had a great Thanksgiving and ready for the New Year! This issue will cover 3 topics:

2024 Fannie/Freddie Updates

Goldman Sachs CRE Risks Report

Mezzanine & Preferred Equity in the capital stack

When treasuries jumped to 5% just over a month ago, I was preaching how three times already this year treasuries had fallen 50bps over a three week span after spiking - this makes it a 4th.

It's within the realm of possibility to secure a 10-year fixed-rate Agency loan at around 6% today, including a few years of interest-only, with leverage up to 75% of value (1.25X min DSCR). We’re advising 5 and sometimes 7 year paper given the yield maintenance prepay penalties that come with the Agencies - not touching 10 year.

If you can acquire a stabilized multifamily property at a true 6%+ cap rate now, achieving immediate positive leverage is very feasible once again!

Current interest rates for maximum leverage Agency loans, featuring flexible interest-only periods and constrained by a 1.25X DSCR and 75% LTV, are currently priced in the low-6% range fixed.

2024 Fannie/Freddie Exclusion Lending Cap Updates

Newsflash - we’re basically already in 2024.

Loans that are classified as preserving "workforce housing", will be excluded from the lending cap.

Key takeaways below:

• Loans will be exempt from the cap if elective income or rent restrictions, as codified within the loan agreement, last for the lesser of 10 years or the life of the loan. FHFA does not specify a minimum unit count requirement.

• Loans will be classified as 50% Mission Driven if < 20% of the units are restricted to the market’s affordability level. (reduced from 50% in the 2023 cap).

• Loans will be classified as 100% Mission Driven if => 20% of the units are restricted to the market’s affordability level. (reduced from 50% in the 2023 cap).

Goldman Sachs Report - CRE Risks

Lender Preferences

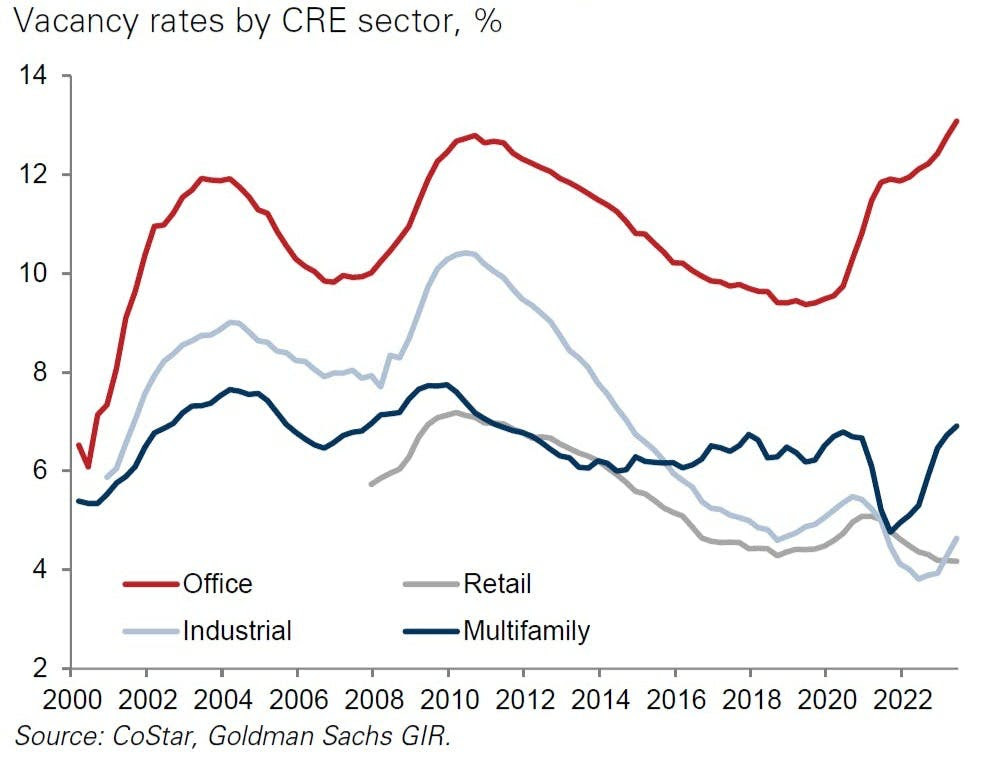

The in-demand asset types are multifamily, industrial, hospitality, data centers, and select retail properties.

Lenders are often willing to extend loans to avoid taking ownership if owners are willing to keep the loan current and put some more money into the project.

Acquisitions are favored given the clarity on valuation.

Almost no 10-year fixed-rate loans are being originated. Most borrowers are focusing on 5-year fixed-rate deals on the hope of being able to refinance at lower rates in the coming years.

Goldman's Thoughts on the Banking Sector

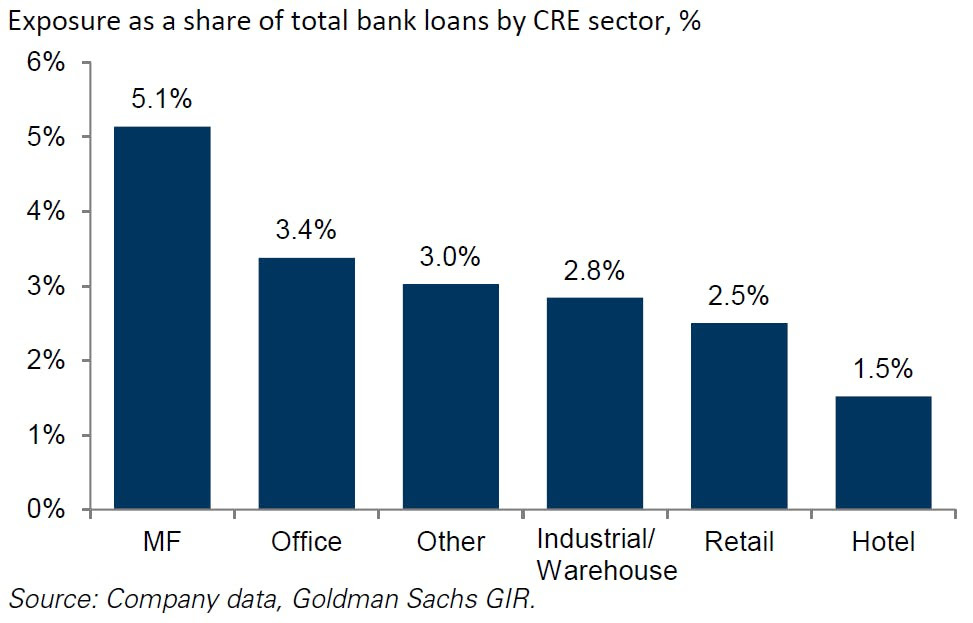

Banks have $2.8 trillion of outstanding CRE debt and 75% of that is small and mid-sized banks.

Fears of a systemic shock from CRE are overblown for three key reasons: i) Banks have already set aside reserves for office loan losses around 7.5%, ii) Bank capital ratios have strengthened over recent quarters, and iii) loan modifications could make the accumulation of losses a slow process.

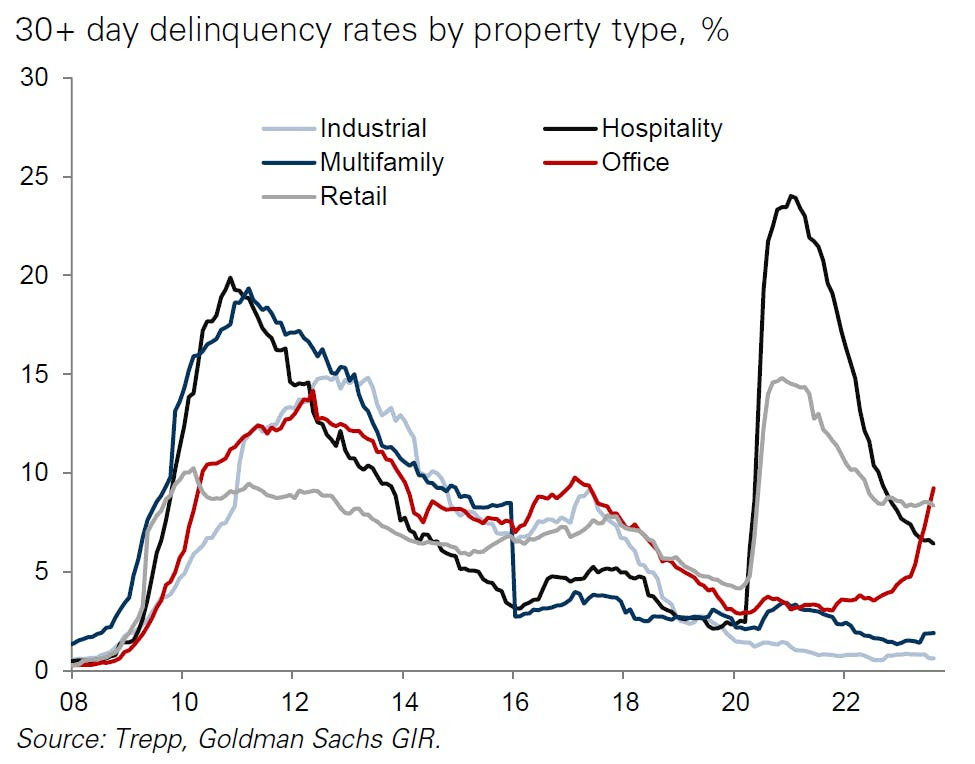

FDIC data on bank loan performance indicates that the share of non-multifamily CRE loans behind on payments has increased to 0.82%, but is still well below the post-GFC (4.4%) and Savings & Loans Crisis (5.4%) peaks.

Banks' exposure to office loans is only around 3% of all bank loans. Within office, small/regional bank lending is skewed toward smaller suburban and medical office loans in secondary and tertiary markets rather than the larger CBD office loans in major markets that sit at the center of the current stress in the sector.

Only 15% of office loans on banks' balance sheets are set to mature annually over the next couple of years.

CMBS Market

CMBS origination has sharply contracted and is on pace to fall to the weakest annual volume since the GFC.

The CMBS market is signaling stress in three ways, i) the number of delinquent borrowers and those placed in special servicing has risen, ii) CMBS bond pricing has deteriorated sharply with BBB's widening 700 bps since mid-2021 to above 900 bps today, and iii) underwriting standards demanded by lenders and CMBS investors have tightened significantly.

The delinquency rate for office CMBS loans has risen to 5.6% as of September 29th, up from 1.6% a year ago.

Non-office CMBS loans have exhibited a decline in credit stress, particularly stemming from improvement in the retail and hospitality sectors.

In the CMBS market, over 40% of office maturities over the past three months received maturity extensions rather than full-principal payments.

Is Preferred Equity the Solution to My High-Leverage Construction/Bridge Loan?

There are many high-leverage construction and bridge loans on multifamily properties across the US. These properties were originally structured with the expectation of refinancing with Fannie/Freddie Mac loans upon stabilization. However, these transactions now face a significant challenge due to rising interest rates. Relying solely on agency financing will likely no longer be a viable refi strategy for these floating-rate loans, without a substantial cash infusion. (Banks and LifeCos are unlikely to be a silver bullet either.)

To effectively navigate this changing landscape, it becomes essential to explore alternative options, such as securing subordinate capital. Subordinate lenders/preferred equity providers typically target an in-place debt yield of around 8% (as of today). This figure is derived from their aim to maintain a 1.05 DSCR, calculated based on the amortizing pay rate of the senior loan and the current rate of the subordinate capital. Currently, subordinate loans are priced at approximately 14% (50% PIK/50% current pay) and are interest-only.

It's worth noting that while subordinate loans can help reduce the cash-in, in many cases, they may still not be enough to refinance out the existing loans completely - it's hard as some of these construction/bridge loans were underwritten with 7% take-out debt yields in mind.

It's important to make a market for preferred providers and get the best terms with a partner that works for you. Let me know how I can help you.

LTV: 75%-80%

DSCR: 1.05X (Based on the Amortizing Senior and Current Rate on Pref)

Debt Yield: 7.5-8.5% (In-Place)

Upfront Fee: 1%

Recourse: Non-Recourse

Term: Co-terminus with Senior Loan; 3-10 years

Amortization: Interest only

Interest Rate: 12-14% (50% PIK / 50% Current)

Mezzanine & Preferred Equity

Most groups, both new and experienced are seeking pref equity to fill in the capital stack given the low leverage being offered in most cases.

That being the case, I wanted to touch base on one key question that can save millions in mezz/pref financing costs: “Can you please provide a list of the mezz/pref groups where you have already negotiated an intercreditor or recognition agreement?”

It matters for two main reasons:

1) When you work on a transaction that includes senior debt combined with mezz/pref, an agreement is required between the senior lender and the subordinate lender. For mezz it’s called an Intercreditor Agreement and for pref it’s called a Recognition Agreement.

This can be a time-consuming and expensive document for the lenders to negotiate between themselves as it governs what happens if the borrower defaults. The borrower is responsible for the cost of negotiating this agreement even though they're not a party to it.

By asking the question above, you’ve effectively asked for a list of groups they’ve worked with in the past and have already negotiated a critical document to getting a deal closed. Some lenders never come to terms on these documents and deals fall apart, so it’s helpful if you’ve eliminated that risk.

2) The number of mezz/pref groups in the market is constantly growing. By asking senior lenders who they've worked with in the past, you'll potentially identify new mezz/pref providers.

Debt Funds

Debt funds are targeting "low-to-mid teens" returns, which can mean 11-14% for multifamily and 14-16% for riskier asset types.

In order to generate these types of returns, debt funds are both lenders and borrowers.

They're providing you a high leverage "whole loan" at a certain interest rate (e.g. 75% LTV at SOFR + 3.50%) and then borrow 75-80% of that capital from one of their relationship banks at a lower cost to create a higher return for themselves.

Fees matter and will impact levered yields. Debt funds will charge 1 point (100 bps) in and 1 out most of the time.

A debt funds warehouse lender is significantly important to their operation. Some debt fund lenders are able to reduce pricing 25 basis points and still earn the same return as the opposing lender because their warehouse line is providing an 80% advance rate instead of a 75% advance rate.

Securing the Best Financing Possible

When it comes to securing the best loan for your real estate ventures, a collaborative team effort can make all the difference.

Involve your whole team to get the best loan possible. For example, your insurance broker can scrutinize lender-proposed insurance requirements and negotiate out unneeded coverage, bringing the premium down as much as possible.

This not only saves you money on expenses, but also lets the lender underwrite lower expenses, and thus derive a higher valuation and greater loan amount.

Your debt broker should identify the best lender candidates that fit the deal profile and then create competition between them to deliver the most competitive loan terms. Create a market.

Your property management company should put together a budget showing the leanest possible expenses for the lender. While agency lenders can only underwrite revenue to in-place numbers, they can underwrite expenses to a budget. It is thus critical that your property management budget lets the lender to arrive at the strongest underwritten net cash flow.

YOY Agency Multifamily Activity

Fannie Mae

Freddie Mac

Top Multifamily Deals of the Month

Chetrit Lands $235M Construction Loan for UES Condo Tower

Tower Companies Secures $188M Refi for Silver Spring Multifamily Campus

Otéra Capital Provides $99M for Greystar Multifamily Refinancing in Denver

MF1 Capital Provides $101M Refinancing for Nashville Mixed-Use Multifamily

PGIM Lends $115M for West Los Angeles Apartment Complex

[1] https://commercialobserver.com/power-series/2023-lenders/?utm_source=sailthru&utm_medium=email&utm_campaign=cofw&utm_term=11/16/2023

[2] https://www.globest.com/2023/11/29/multifamily-capital-markets-continue-to-struggle/kw=Multifamily%20Capital%20Markets%20Continue%20to%20Struggle&utm_position=1&utm_source=email&utm_medium=enl&utm_campaign=multifamilyalert&utm_content=20231130&utm_term=rem&oly_enc_id=8997H9317367C1S

[3] https://www.pensford.com/industry-news/inflation-data-should-confirm-the-fed-is-done?utm_medium=email&_hsmi=284122460&_hsenc=p2ANqtz-8PH-ZYBn0JUfccWPji7F0FHNDKkwQaUgvlejc25aD8kJLVhkAYOP5dqL66rk2groLaV1a0EBq8J5L5684HrMm2ZHuUT0W66RmdxhzAxkFHWDKgk0&utm_content=284122460&utm_source=hs_email

[4] https://www.multifamilydive.com/news/apartment-development-housing-starts-multifamilyfinance/700731/utm_source=Sailthru&utm_medium=email&utm_campaign=Issue:%2020231128%20Multifamily%20Dive%20%5Bissue:56792%5D&utm_term=Multifamily%20Dive

About Me

Niche focus on Multifamily. We operate across the full capital stack.

Direct on Agency

Broker on Bridge (Banks, Debt Funds, Life Co’s, etc)

Preferred Equity placement

Common Equity placement for the right sponsors/projects

Creating JV Equity & Co GP partnerships

If you’re on LinkedIn, please add me if we’re not already connected.

Thank you!